Insights by bill beckham

After 27 years in P&G finance and first-hand franchise ownership, I write about the facts behind franchise investing so you can make confident, data-driven decisions.

Stay Ahead of the Franchise Curve.

Join 500+ professionals who get weekly insights from Franchise Clarity on LinkedIn.

The “Safe Bet” Trap: Why Familiar Franchises Aren’t Always the Best Choice

There’s a common assumption among franchise buyers: If a brand is well known, it must be well run.

But in franchising, familiarity doesn’t always equal strength — and visibility doesn’t always translate to franchisee success.

What a Good Franchisor Looks Like: Green Flags to Watch For

Over the last few weeks, I’ve written a lot about red flags in franchising — warning signs buried in the FDD or hidden behind the sales pitch. Those posts have struck a chord, but I don’t want to leave the impression that every franchisor is out to take advantage of you. The truth is, there are strong systems out there. The challenge is knowing how to spot them.

Should You Buy an Existing Franchise Instead of Starting One from Scratch?

When most people think about franchising, they picture cutting the ribbon on a brand-new location. But there’s another path: buying an existing franchise from a current owner.

How do you know which path makes sense for you? Let’s break it down.

Franchise Failures Are More Common Than You Think

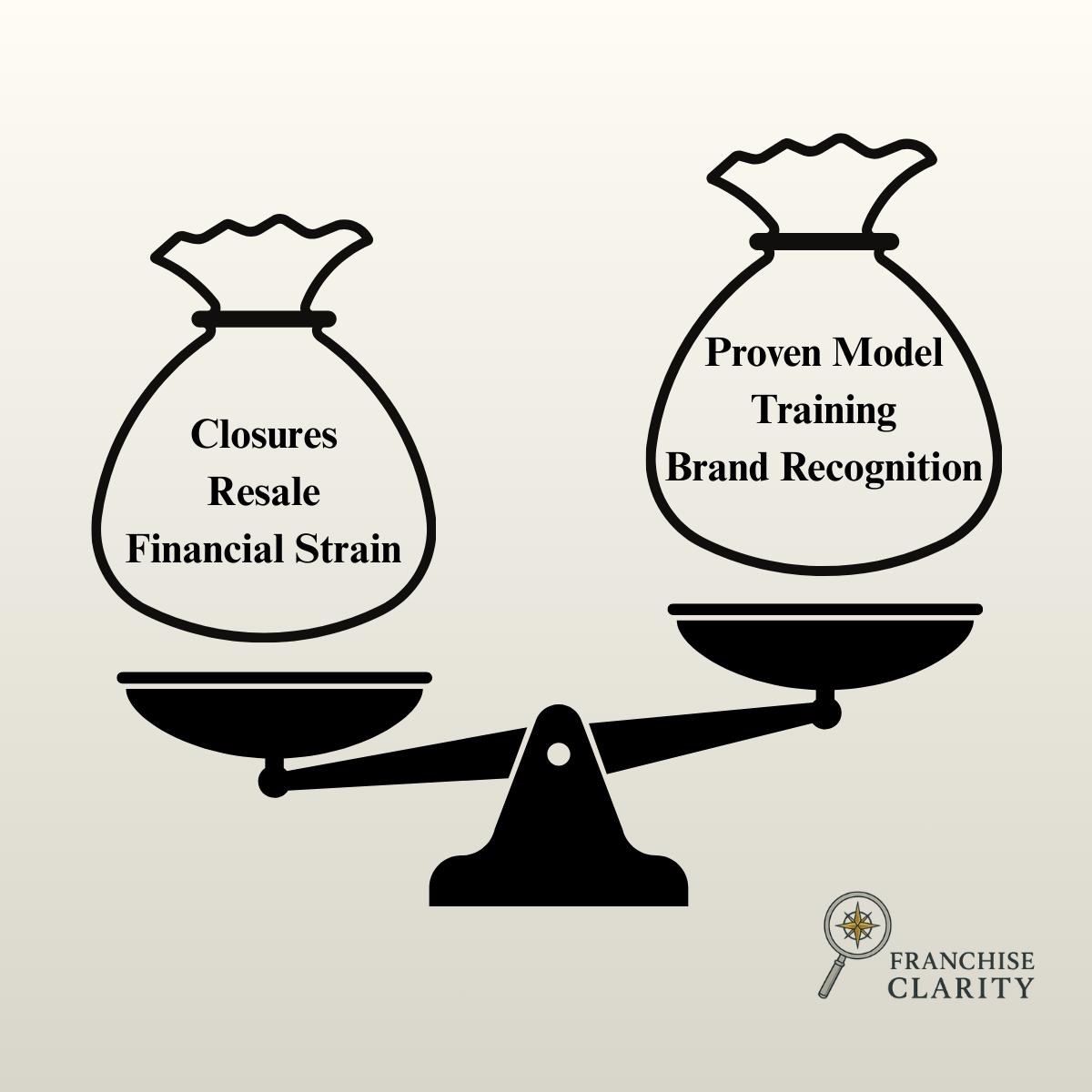

Franchising is often positioned as a safer way to own a business—brand recognition, a proven model, training, and support all bundled into one package. Compared to starting from scratch, it feels like the odds are in your favor.

But here’s what rarely makes it into the sales pitch: franchise failures happen more often than most people think.

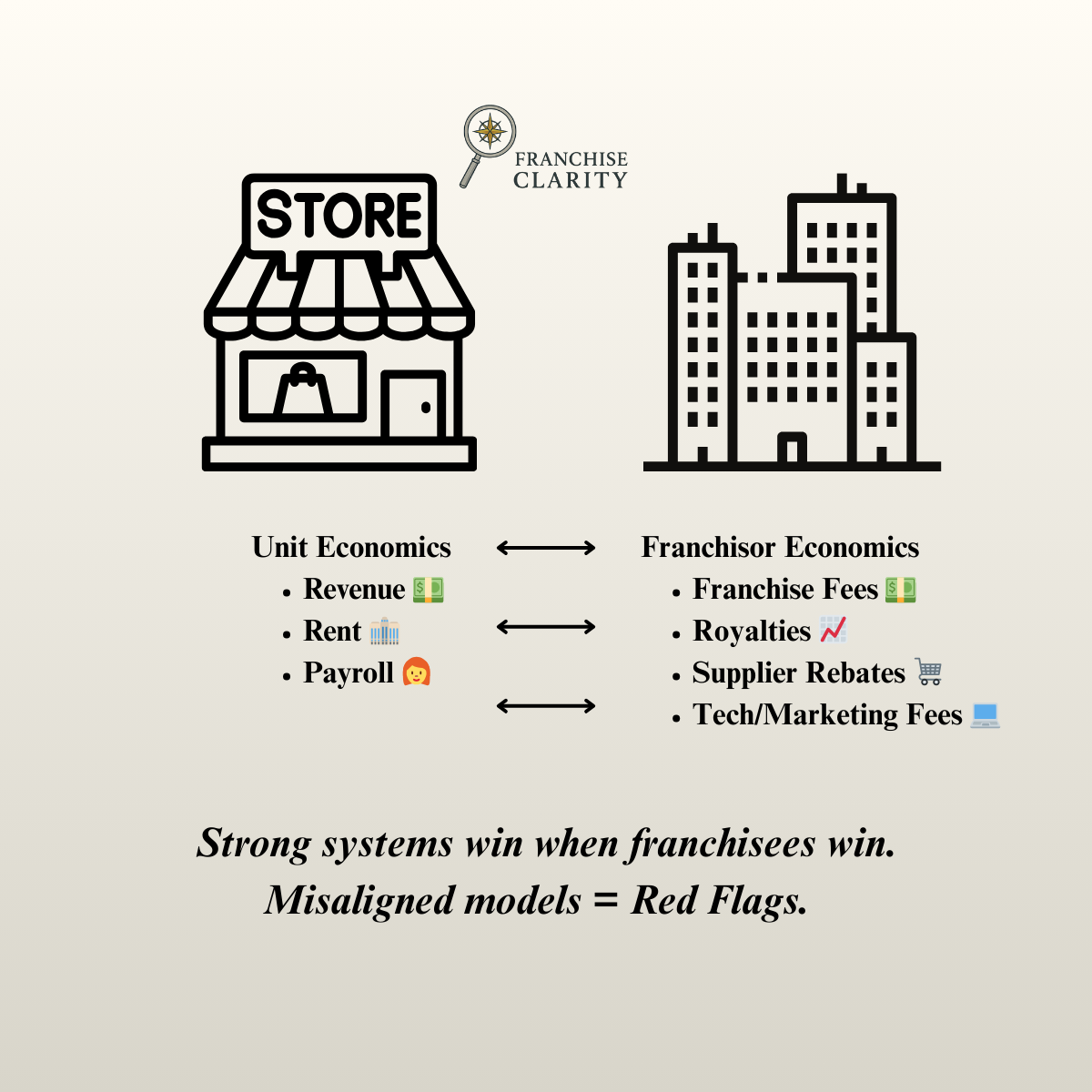

The Franchisor’s Business Model: What You Should Be Evaluating (But Probably Aren’t)

When prospective franchisees evaluate opportunities, they tend to focus on the unit economics—how much revenue a location can generate, what the margins look like, and how quickly they can break even. That’s important, but it’s only half the story.

5 Due diligence mistakes that cost franchisees thousands

Franchising can look like a “safer bet” than starting from scratch. But every year, smart people still lose money because they rushed through due diligence or trusted the wrong person. This article provides an overview of five common mistakes I see over and over again — and how to avoid them.

rOI math: what item 19 really tells you (and what it doesn’t)

For many prospective franchisees, Item 19 is the most scrutinized part of the Franchise Disclosure Document (FDD).

On the surface, it looks like a shortcut to understanding how much money you might make. But here’s the reality: Item 19 is a starting point — not a conclusion. And reading it at face value can lead to costly assumptions.

Why the FDD Doesn’t Tell the Whole Story

The Franchise Disclosure Document (FDD) is meant to protect buyers. It’s long. It’s legally required. It looks official.

But here’s the truth: The FDD is a starting point, not the full story.